When Europe sank into a debt crisis, cash flowed into Denmark. When Switzerland abandoned its peg, cash flowed into Denmark. And when Britain voted to leave the European Union, cash flowed into Denmark.

Updated on

Peter Levring

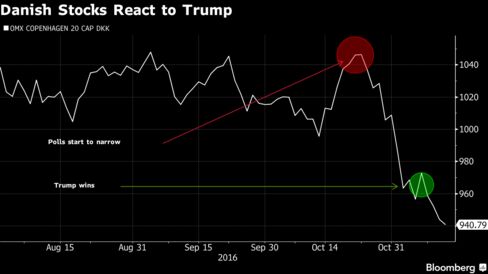

But with a stock market heavily weighted toward trade, Denmark lost its allure in Donald Trump’s world.

“Some of Donald Trump’s ideas are pretty negative for Denmark and Danish kroner,” said Las Olsen, chief economist at Danske Bank A/S, Denmark’s biggest lender.

Danish benchmark stocks dropped after Trump’s victory. The main index, which is dominated by names like A.P. Moller-Maersk A/S, a global shipping giant, and Vestas Wind Systems A/S, the world leader in turbines used to produce renewable energy, lost 3.3 percent last week, moving in the same direction as the MSCI index for emerging markets.

Reading Trump

Reading Trump

Assuming Trump will set off a U.S. construction boom (to build the wall?), investors anticipating a spike in inflation started dumping bonds last week. Yields soared, as did a broad swath of stock indexes.

But the trade war that Nordea Bank, among others, warns Trump will trigger promises to be particularly punishing for the Danes. They rely on exports for about half their economic output. Nordea estimates Denmark could lose up to 10,000 jobs if Trump acts on his rhetoric.

Danske Bank says Trump’s policies could reduce Denmark’s current account surplus by one-third. That would bring it to about 6 percent of gross domestic product -- still a huge figure -- but the size of the shift will hit the exchange rate.

Currency Peg

That means the central bank, which defends the krone’s peg to the euro, is no longer fighting the massive inflows that forced it to keep interest rates mostly negative since 2012. (For much of last year, Denmark’s main rate was minus 0.75 percent, before a 10 basis point increase in January.)

According to Nordea, investors no longer think those negative rates are worth enduring given the dimming allure of Danish assets.

“There’s a limit to how much of a safe haven you get from government debt that offers no return,” said Helge Pedersen, chief economist at Nordea in Copenhagen.

‘Choleric Agitator’

Anders Dam, the chief executive officer of Jyske Bank A/S, says Trump’s policies will probably force the central bank to exit its negative rates as early as a year from now. But for the time being, most economists tracking Denmark are sticking with their forecasts, which point to negative rates persisting at least through 2018.

That’s because “we basically don’t know what Trump will do,” said Jes Asmussen, chief economist at Svenska Handelsbanken in Copenhagen. For now, it’s as though “people have forgotten how panicked they were when he was talking about all the things he’d do, and all of a sudden we have to believe he’s not a choleric agitator.”

http://www.bloomberg.com/news/articles/2016-11-13/one-less-haven-for-investors-as-trump-damages-denmark-s-appeal