Property busts are linked to an 18-year land cycle

This is actually a radical departure from mainstream thinking: which is that those peaks were caused by credit bubbles.

They weren’t.

These guys discovered that it’s all about the LAND.

Bank credit blows up and deflates in synch with this land cycle.

Not the other way around.

But again: why should you care about all this here in the UK?

That’s where the second part comes in...

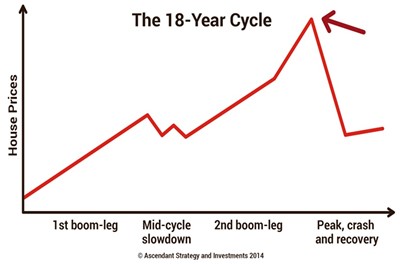

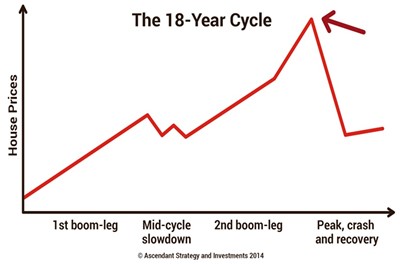

So what happens inside this Cycle?

THE ANSWER IS THE SAME, EVERY TIME...

At the beginning of an 18-year cycle, land values (and thus house prices) rise for about 14 years, as the charts to the right prove.

Then they hit a peak.

The banks that financed the land boom via huge credit growth get into trouble.

When banks struggle, credit contracts, property falls and the stockmarket follows suit.

And there’s the key:

The stockmarket crash is effectively caused by the real estate downturn.

The real estate downturn tends to last, on average, around four years.

Then economic expansion begins again.

In the four years that follow the bottom of the stockmarket, new business generation leads to a recovery in stocks.

The stockmarket always recovers first.

The property market recovery follows...and the cycle begins anew.

Fourteen years up, four down. Which is why these guys call this the “Grand Cycle”:

18 = 14 + 4

They didn’t just pull this equation from thin air. They pulled it from history.

Here, take a look at this...

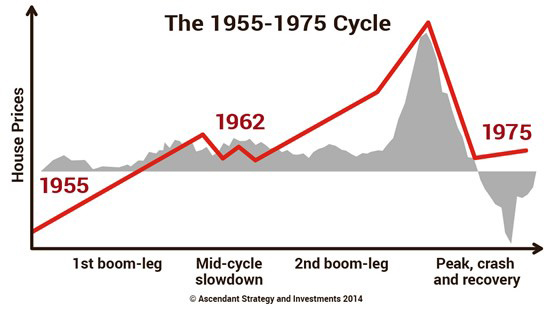

This is the American housing market between 1955 and 1973/‘74.

18 years.

14 years of rising prices between 1955 and 1969. Four years of down prices to the 1973/74 low.

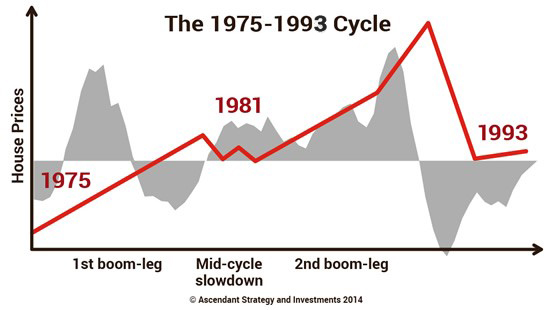

Next cycle. 1975 to 1993.

You can see again, big recovery after the last cycle. 14 years up. 4 years down.

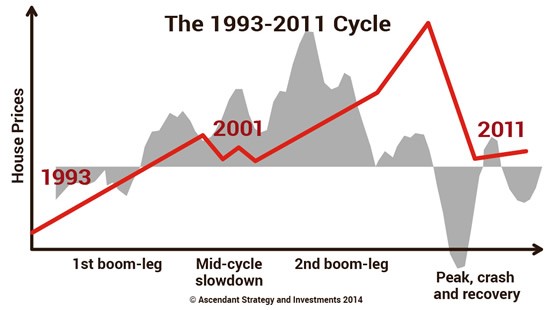

Next cycle.

14 years up. Four down.

Now we’re up to date.

Look where we are on that chart. We’ve had our four years of falling house prices.

The current cycle has plenty of time left to run.

So we’re looking at booming British property AND stock prices until around 2025/26!

That may seem counterintuitive with all the negative coverage that markets have gotten over the last six months.

But, as I’ve shown you today, a lot of this is completely counterintuitive to what you’ll continue to get fed by the mainstream press.

Here’s what comes next for UK property

Most people don’t understand the economic rent.

They don’t understand land prices.

And they don’t believe in the idea of market cycles… despite all the evidence to back them up.

You’ve seen how misguided that view is today. As you’ve seen, once you understand land and the grand cycle… the future IS knowable and predictable.

So what’s coming next?

Well, we can be incredibly specific about that… because the Grand Cycle gives us a TIMETABLE for the future.

Remember, history shows us there’s an 18-year cycle. 14 years up. 4 years down.

The current cycle started in 2011… at the end of four years of falling or flat prices during the financial crisis.

Now we’re six years into the new cycle. The evidence bears this out: house prices have been rising gently since 2011.

Here’s what comes next:

PROPERTY PREDICTION #1: Brexit will affect sentiment but NOT prices.

Don’t expect Brexit negotiations to bring prices down – at all. In fact, expect them to keep rising. Brexit will dominate the press, but it won’t affect the land cycle. Don’t allow sentiment to cloud your judgement.

PROPERTY PREDICTION #2: the market will stall in 2019.

As the chart above shows, each 14-year expansion comes in two distinct parts. In the middle you get a slowdown. This happened in 1962, 1981 and 2001. It’ll happen again around 2019. Expect prices to flatline, or even dip slightly. The media will describe this as “fallout” from the Brexit deal. That’s wrong. The Grand Cycle is the real driver here.

PROPERTY PREDICTION #3: huge boom 2020-2024.

If you want to make money from UK property, you need to be in the market between 2020 and 2024. That’s when the second half of the cycle will really kick in and drive property to new highs. Prices could double in this period. Be sure to get out by 2024 though, because…

PROPERTY PREDICTION #4: the property mania of 2024-2026.

This is the most dangerous phase of the cycle. Prices will continue to explode. But seasoned property experts will be out of the market. It’s not the time to take on debt to buy property – no matter how much money you’ve made in the boom. Expect to see the “tallest building in the world” built at this stage, as a monument to the final phase of the cycle.

PROPERTY PREDICTION #5: the next bust starts, 2026.

If history is anything to go by, this could be accompanied by a financial crisis. It’s the time to be out of the market, waiting the four-year downturn out. (Or the time to have funds on hand to snap up bargains.)

In short… now is NOT the time to take a backward step on property.

The sentiment might be poor… but the cycle tells us there’s a HUGE amount of money still to be made.

Consider… if the average home price in Britain doubles from here, as the cycle suggests… it’ll be worth at least £193,000 MORE than it is today. That’s big money. Life-changing money…

Because this is a life-changing IDEA.

Or to put it another way, the most valuable financial information in the world isn’t knowing what to buy.

It’s knowing when to buy

Get your timing right, and it doesn’t really matter what specific stock, property, commodity or currency you buy.

Get your timing right, and you’ll make money regardless.

The cycle does the work for you.

Imagine if you, too, could see clear as day what was coming...

- You’d know when to buy more stocks... and when to sell them...

- You’d know in advance if it’s a good time to buy a property... or to stay out of the market...

- You’d know what’s coming in the commodity markets, and therefore whether to own or sell mining stocks...

There are plenty of investment newsletters telling you “what” to buy.

That’s relatively easy.

There are thousands of stocks in the world. Just pick one!

But can you think of many financial advisories that tell you WHEN to buy and when to sell... months in advance... narrowing that instruction down to a specific future month, or even week?