By

- Davis, Barnier hold joint news conference late morning in Brussels

- As round five draws to a close, focus in the U.K. is on planning for no deal

Instead, with less than 18 months to until Britain tumbles out of the EU, deal or no deal, the two sides are still battling over what was meant to be the easy part, and the U.K. government is still battling itself on how to approach talks.

Philip Hammond

Photographer: Luke MacGregor/Bloomberg

Those divisions were on display yesterday as Chancellor of the Exchequer Philip Hammond gave his vision of Brexit, which is decidedly gloomier than that of his more pro-Brexit colleagues. Most striking was that even Hammond, who says he’s reluctant to spend taxpayers’ money on unnecessary planning for a no-deal scenario just to score negotiating points, said he would start releasing cash as soon as January if progress isn’t made in talks.

Some of his colleagues want him to start spending large amounts now on contingency planning to prove to the EU that Britain is serious about walking out. The government has already set aside £250 million ($331 million), and further funds will come from reserves, Hammond said.

Judging by the latest EU rhetoric, the chances of that money being spent are growing. The goodwill that Prime Minister Theresa May generated in her September speech in Florence, where she promised to pay into the EU budget for two years after Brexit and asked in return for a transition period to help businesses prepare, hasn’t helped talks.

Last month, EU leaders were said to be considering expanding the mandate of the EU’s chief Brexit negotiator, Michel Barnier, to allow discussions on the transition in October. On Wednesday an EU official said that was unlikely to happen. Leaders at a summit next week will almost certainly say not enough progress has been made to move on to trade talks, the official said. December is now the next possible date to reach that milestone, leaving the U.K. with less than a year to sketch out a future relationship with its most important trading partner.

Still, there’s one piece of potentially good news, from Germany: the government there wants the EU to be prepared to grant U.K. banks transitional access to the EU if the Brexit process drags on, Bloomberg’s Brian Parkin and Birgit Jennen report. That would chime with the position of German policy makers who have warned of the risks to German companies of harming London as a financial center.

Brexit Latest

Amendment Attempt | Two lawmakers, one Conservative and the other Labour, have joined forces to amend the pending EU Withdrawal Bill, seeking to enshrine in law the proposals May made in Florence. That would stop any government executing Brexit if the withdrawal deal doesn’t include transition arrangements, and effectively block a “no-deal” exit.

Welsh View | First Minister of Wales Carwyn Jones said getting no deal from talks would be a disaster. He told Bloomberg TV he fears tariffs on steel and lamb, along with increased costs, bureaucracy and customs checks at Welsh ports dealing with Ireland.

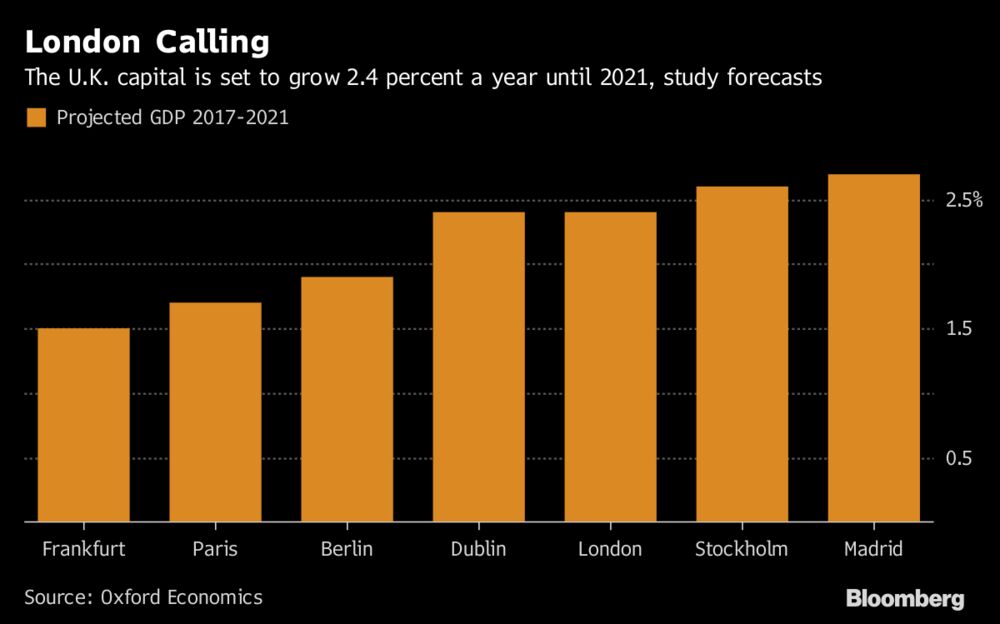

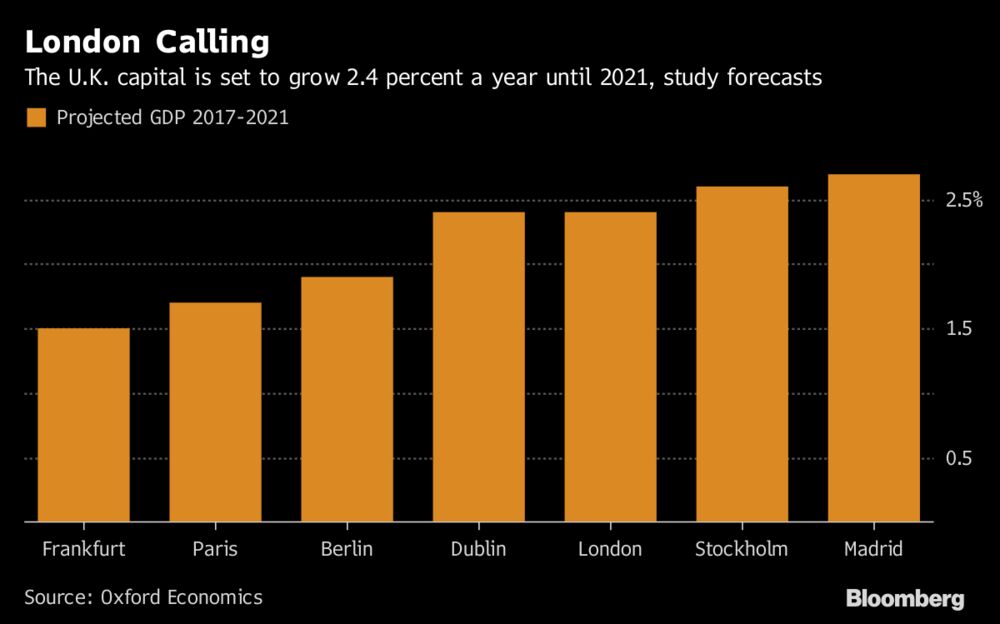

London’s Star | London will outperform many other European cities, including Frankfurt and Paris, with economic growth averaging 2.4 percent a year until 2021, according to Oxford Economics. A separate report showed Britain’s capital city maintained its top position in the Global Power City Index.

Oxford Economics

Nuclear Plans | The U.K. published draft legislation on Wednesday to create a domestic nuclear safeguards system that will replace provisions under the European Union’s Euratom treaty once Britain has left the bloc.

Paris Move | Bank of America Corp. signed a lease for office space in Paris, formalizing plans to move its European trading hub to the French capital after Brexit, people familiar with the decision said.

Luxembourg Win | Citigroup’s private bank is setting up a new booking center in Luxembourg to allow for the possibility of handling its EU clients’ accounts there in the event of a hard Brexit, the Financial Times reports.

Costs Rising? | A so-called hard Brexit would cost about £11,500 pounds ($15,000) per British worker by 2030, Rabobank analysis shows. Barriers to trade, lower investment, a loss of financial services and lower immigration would all weigh on growth, the bank’s economists said.

On the Markets | Investors are anticipating wider swings in sterling amid a growing focus on U.K. politics and the Brexit process. That’s what the options market is showing, according to Bloomberg’s Vassilis Karamanis.

And Finally...

One of the architects of the Leave campaign, Dominic Cummings, is worried that Brexit will end in disaster, according to Prospect magazine. May and Davis “have provided a case study of grotesque uselessness,” and “schoolchildren will shake their heads in disbelief that such characters could have had leading roles in government.”

Civil servants are already drafting their emails with their minds on the public inquiry that will inevitably follow if Brexit ends in catastrophe, he tells the magazine.

https://www.bloomberg.com/news/articles/2017-10-12/brexit-bulletin-one-step-back?