By

Updated on

- Aberdeen, SEB see sterling at 80 pence to the euro in 2018

- Pound risk reversals reach most bullish level in two months

Viraj Patel, FX strategist at ING, discusses the impact of Brexit negotiations on the pound.

Even as Brexit talks lurch from one hurdle to another, the pound is enjoying a rising wave of confidence among investors and analysts.

Aberdeen Standard Investments recently added to sterling long positions, betting it will rally in 2018 as Britain and the European Union make better progress in their negotiations than the market expects. The currency will also benefit from the prospect of interest-rate increases by the Bank of England, according to the U.K. firm and JPMorgan Asset Management. Strategists at SEB AB recommend buying the pound while those at Nomura International Plc see room for gains next year.

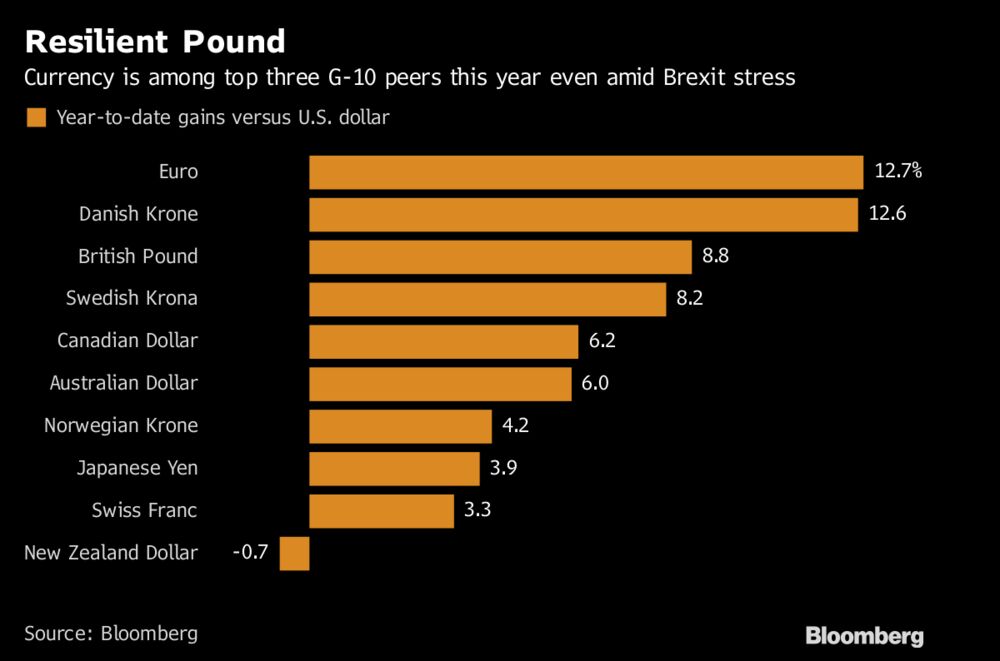

Option-market sentiment on sterling is now the most bullish in two months and it is one of this quarter’s top performers among major currencies against both the dollar and euro. Concessions made by Britain last week on the contentious Brexit bill suggests the likelihood of further “U.K. capitulation” on other topics, allowing a transitional deal and giving the BOE a green light to raise rates, according to Nomura strategists including Jordan Rochester.

“There is too much pessimism about the path of the U.K. economy,” said James Athey, a senior investment manager at Aberdeen Standard, which oversees a total of 670 billion pounds ($899 billion) in assets worldwide. “There’s too much pessimism on the negotiations and the future relations with the EU and I think BOE interest rates will be higher by the end of 2018. I am still long sterling and I’ve added to that position recently.”

Option Optimism

The pound slipped 0.4 percent to $1.3425 as of 10:10 a.m. in London on Tuesday, after the U.K. and the EU failed to get a much-hoped breakthrough on Brexit with the issue of an Irish border derailing a tentative deal. Against the euro, sterling was 0.4 percent weaker at 88.33 pence. Still, three-month risk reversals in the British currency against the dollar, a measure of the appetite for bullish options relative to bearish ones, traded near the highest since Oct. 5 reached on Tuesday.

The increased sterling optimism is also evident from Bloomberg currency surveys. About a fourth of the predictions see the pound rising to $1.40, a level not since the Brexit referendum, in the coming year. A year ago, there were no forecasts for that level to be met any time in 2017.

Aberdeen Standard’s Athey prefers to express pound optimism against the euro rather than the dollar, saying that there has been “far too much exuberance” in Europe’s shared currency. He sees sterling strengthening almost 10 percent to 80 pence per euro “over the medium term.”

Selling the euro against the pound with a target of 80 pence is among the top 2018 trade recommendations from SEB strategists including Richard Falkenhall. Nomura is “still short euro-sterling, looking for 0.87 and pound-dollar to break its September highs and approach $1.40 in the new year,” strategists at the bank wrote in a client note dated Nov. 28.

Rate Outlook

Aberdeen Standard’s Athey and Nicholas Gartside, chief investment officer for fixed income at JPMorgan Asset, see room for the BOE to raise its benchmark rate twice next year, compared with current money-market pricing for a single 25-basis-point increase by November 2018.

While uncertainties around the U.K.’s exit from the EU still linger, the fact that the pound is set to end the year stronger shows markets are becoming less sensitive to the ups and downs of the protracted Brexit process, according to Gartside. With a little more clarity on Brexit and a likely transition deal there was “no reason” for the pound not to climb toward $1.40 next year, he said in an interview.

“A no deal exit” would be “accompanied by substantial wealth losses in both the U.K. and EU,” SEB analysts wrote in a client note last week. “Given the size of the risk premium, a breakthrough in negotiations would most likely trigger a substantial sterling recovery in 2018. Partly, this may even happen in December if exit talks progress sufficiently to open up negotiations on the future relationship between the EU and U.K.”

— With assistance by Charlotte Ryan

https://www.bloomberg.com/news/articles/2017-12-05/pound-rides-fresh-wave-of-confidence-even-as-brexit-fog-lingersViraj Patel, FX strategist at ING, discusses the impact of Brexit negotiations on the pound.