By

To keep the euro area's accounts in balance, Europe's central banks track flows of money among the members of the currency union. If, for example, a depositor moves 100 euros from Italy to Germany, the Bank of Italy records a liability to the Eurosystem and the Bundesbank records a credit. If a central bank starts building up liabilities rapidly, that tends to be a sign of capital flight.

Lately, Italy's central bank has been building up a lot of liabilities to the Eurosystem. As of the end of September, they stood at about 354 billion euros, up 118 billion from a year earlier -- and up 78 billion since the end of May, before the U.K. voted to leave the EU. The outflow isn't quite as large as during the sovereign-debt crisis of 2012, but it's still significant. The main beneficiary seems to be Germany, which has seen its credits to the Eurosystem increase by 160 billion over the past year. Here's a chart showing the cumulative six-month flows between Italy and Germany and the rest of the euro area:

Voting With Their Money

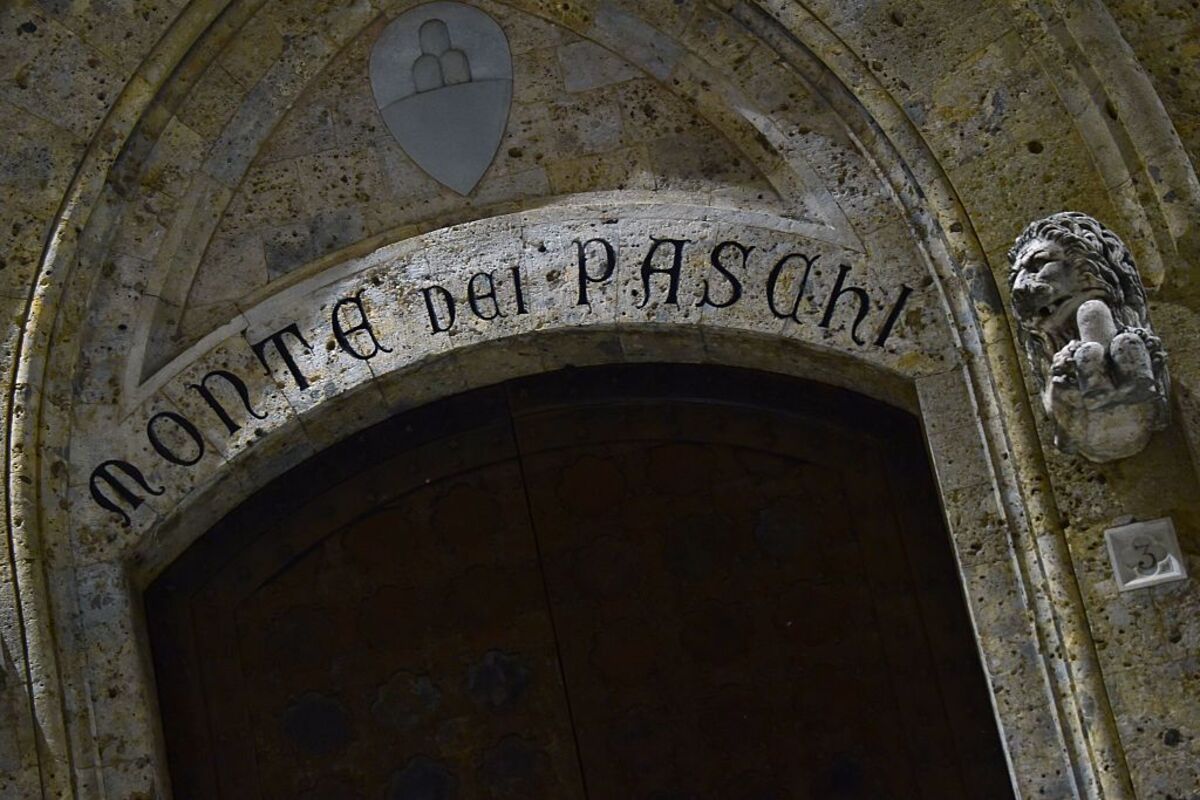

Why the accelerating outflows from Italy? One explanation is that people are worried about the state of the country's banks, which are suffering the consequences of bad lending, poor governance and a new euro-area oversight system that makes rescues difficult. Another is political: Italian Prime Minister Matteo Renzi has staked his fate on a December government-reform referendum that, if it goes against him, could strengthen opponents who want to force a vote on whether Italy should remain in the common currency, a key element of the broader union. In that context, it's not surprising that some depositors prefer not to hold Italian euros, given the chance that they might eventually be converted into lira.

Either way, the capital flight doesn’t speak well of confidence in the European project -- something EU leaders will have to keep in mind as they negotiate the terms of Britain's exit.